Content

Gross profit margin is used to determine the percentage of profit gained after deducting the production costs, known as the cost of goods sold . Profit margins are key performance indicators that provide important information about how your business performs and how much profit your business generates. These KPIs will tell you which products or services aren’t profitable so you can make informed business decisions. Profit margins should always be rising to keep your business growing. Operating profit margin takes into account all overhead, operating, administrative, and sales expenses necessary for day-to-day business operations. However, it does not include debt, taxes, and other non-operational expenses.

How do I calculate a 20% profit margin?

- Change 20 percent to its decimal form of 0.20.

- Subtract 0.2 from 1, equalling 0.8.

- Divide the original price of your product by 0.8.

- This number is what your sale price should be if you want a 20 percent profit margin.

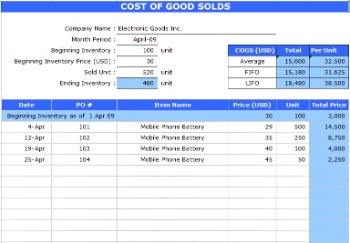

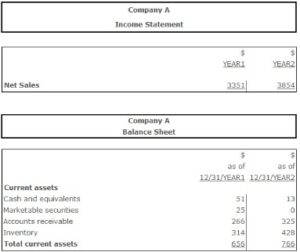

Using this rule, you can quickly assess how you’re doing at a glance. As you can see from the screenshot, if you enter a company’s revenue, cost of goods sold, and other operating expenses you will automatically get margins for Gross Profit, EBITDA, and Net Profit. EBIT is the same thing as Operating Profit; EBITDA is slightly more refined, closer to Net Profit. Gross profit is the profit a company makes after deducting the costs of making https://quick-bookkeeping.net/ and selling its products, or the costs of providing its services. There are some studies that analyze profit margins by industry.New York University analyzed a variety of industries with net profit margins ranging anywhere from about -29% to as high as 33%. For instance, the study showed that the hotel/gaming sector had an average net profit margin of -28.56% while banks in the money center had an average net profit margin of 32.61%.

What Is ‘Profit Margin’?

New and startup business owners need to monitor their company’s finances closely. Looking at your gross profit margin monthly or quarterly and keeping track of cash and inventory will help optimize your company’s performance. This means Tina’s business is doing a little below average, with an 18.75% gross profit margin. She might consider raising her prices or looking for ways to reduce direct costs without cutting quality.

What is 25% profit margin?

So if the ratio is 25%, that means that the company's gross profit margin is 25 cents for every dollar in sales. Higher gross profit margin ratios generally mean that businesses do well at managing their sales costs.

While this figure still excludes debts, taxes, and other nonoperational expenses, it does include the amortization and depreciation of assets. However, some profit margin formulas take into account peripheral expenses, like employee wages and transportation costs, which a product’s markup may not reflect. Net sales can be used interchangeably with revenue for the sake of this formula — it is simply how much money was generated from selling products, goods, or services. The profit margin is a significant financial metric that helps keep track of expenses and improves efficiency for businesses of all sizes. Good profit margins may vary depending on the industry, company size, and other factors. However, a profit margin over 10% is considered good, while a 10% margin is healthy.

Types of Profit Margin

To accomplish this, you need to roll up your sleeves and start setting the profit margin of your business right away. Tina’s T-Shirts is a small business that has been open for about a year. Tina wants to get a better idea of how expenses are affecting her company’s profit. So, she opens her accounting software and starts making some calculations. Branding and promotional techniques may help to improve your profit margin by aiming to add value to the products, which allows customers to continue to purchase products at increased prices.

The net profit margin reflects a company’s overall ability to turn income into profit. The infamous bottom line, net income, reflects the total amount of revenue left over after all expenses and additional income streams are accounted for. This includes not only COGS and operational expenses as referenced above but also payments on debts, taxes, one-time expenses or payments, and any income from investments or secondary operations. Profit margins tell you how much a company makes from selling goods and services after covering direct and indirect costs. Profit margins are percentages that measure profitability — higher percentages mean higher profits. To determine the operating profit margin, we need to divide the operating income or operating profit by the company’s total revenue and then multiply by 100.

How to Calculate Profit Margin in Excel

By analysing the profitability of different products and services, companies can determine which products or services are most profitable and adjust their pricing accordingly. This can help companies maximise How To Calculate Profit Margin profitability and remain competitive in the marketplace. Using the same example above, but taking into account that the variable costs and taxes amounted to $15,000.00, it generated $10,000.00 of net profit.

Profit margin can help to make pricing decisions, identify any issues, and ultimately help grow your business. To increase revenue and profit margins, identify which products or services sell the best and have the most potential to deliver the most profit for your business. Retaining customers and building customer loyalty are reliable ways to increase your profit margins. In fact, acquiring a new customer costs five times more than selling to an existing one. By providing excellent service, personalizing customer interactions, and offering perks like loyalty programs, you can create a dedicated customer base that consistently buys from you.